INDEX

- 1.0Introduction

- 2.0About the Project

- 3.0About Fanpla System

- 4.0Fanpla Economic Zone

- 5.0Technical Specifications

- 6.0Toke Sales and Usage Plan

- 7.0Road map

- 8.0Team

- 9.0Terms of service and Privacy policy

- 10.0Disclaimer

- Revision Log

-

- Revision Log

6.0Token Sales and Usage Plan

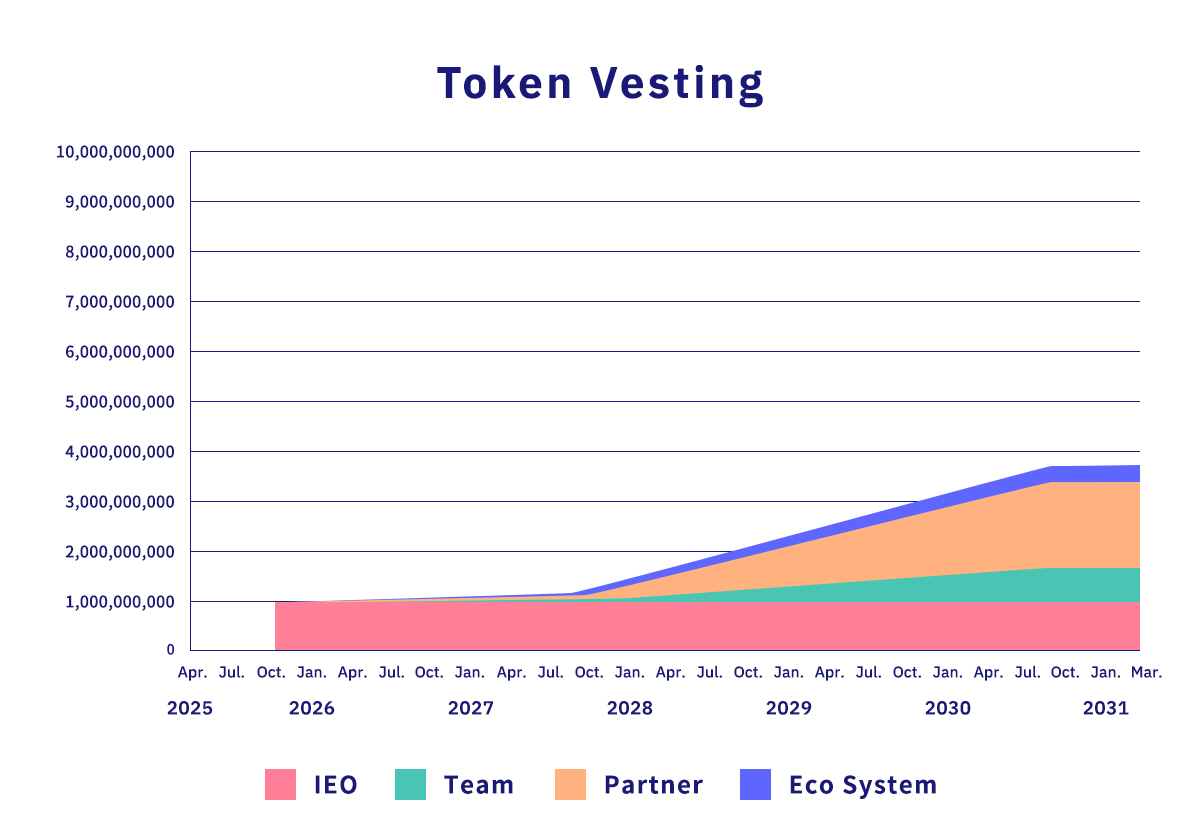

6.4 Lock-up and Release

Lock-up periods and vesting periods are set for each FPL allocation. During the lock-up period, the sale of FPL will be restricted, and during the vesting period, FPL is gradually released from the lock-up and can be sold. (These periods are subject to change including re-lock-up depending on market conditions and development progress.)

| Allocation | Lock-up Period | Vesting Period |

|---|---|---|

| IEO | None | None |

| Ecosystem | None | None |

| Team | 24 months | 36 months |

| * Partner | 24 months | 36 months |

*For tokens for commission fees for IEO consignment sales operations, Coincheck will voluntarily restrict sales (3 months).

[Allocation Release and Market Volume]

*This is a forecast value and does not guarantee that this quantity will be distributed on the market.

Additional Issuance

The target for additional issuance is limited to the ecosystem (no additional issuance will be conducted in other categories). An issuance cap is established, and issuance will be carried out as needed; if deemed unnecessary, no issuance will occur. To ensure fairness and eliminate arbitrary issuance or human errors, the decision to issue will be made through a formalized approval process. Additionally, the maximum amount of additional issuance within the ecosystem is set at 25,000,000 coins per year for IEO Phase 1, and 60,000,000 coins annually from IEO Phase 2 to Phase 6. For the 6,165,000,000 coins (61.65%) that may be additionally issued from Phase 7 onward, all will be deemed as additional issuance within the ecosystem. The issuer will determine the appropriate amount of additional issuance based on considerations such as trading volume and market circulation, ensuring that it does not significantly impact the circulation market of FPL.

About the Issuer’s FPL Sale

The FPL held by our company is planned to be sold on the market. The total amount sold on the market is limited as shown in the table below.

Fiscal Year:Sales Limit

March 2026(IEO Phase 1): ―

March 2027(IEO Phase 2): 2% of the total circulation

March 2028(IEO Phase 3): 3% of the total circulation

March 2029(IEO Phase 4): 4% of the total circulation

After March 2030(IEO Phase 2): 5% of the total circulation

Percentage of total issued token relative to market circulation at the end of the period

- Fiscal Year

- IEO

- Team

- Partner

- Ecosystem

- Total

- Uncirculated portion

-

FY2026, ending Mar

(IEO Phase 1)1,000,000,000

10.00%0

0.00%50,000,000

0.50%25,000,000

0.25%1,075,000,000

10.75%8,925,000,000

89.25% -

FY2027, ending Mar

(IEO Phase 2)1,000,000,000

10.00%0

0.00%50,000,000

0.50%85,000,000

0.85%1,135,000,000

11.35%8,865,000,000

88.65% -

FY2028, ending Mar

(IEO Phase 3)1,000,000,000

10.00%118,333,333

1.18%341,666,667

3.42%145,000,000

1.45%1,605,000,000

16.05%8,395,000,000

83.95% -

FY2029, ending Mar

(IEO Phase 4)1,000,000,000

10.00%355,000,000

3.55%925,000,000

9.25%205,000,000

2.05%2,485,000,000

24.85%7,515,000,000

75.15% -

FY2030, ending Mar

(IEO Phase 5)1,000,000,000

10.00%591,666,667

5.92%1,508,333,333

15.08%265,000,000

2.65%3,365,000,000

33.65%6,635,000,000

66.35% -

FY2031, ending Mar

(IEO Phase 6)1,000,000,000

10.00%710,000,000

7.10%1,800,000,000

18.00%325,000,000

3.25%3,835,000,000

38.35%6,165,000,000

61.65%